26+ Mortgage loan amortization

Amortization Period - The actual number of years it will take to repay a mortgage loan in full. For All New Loans.

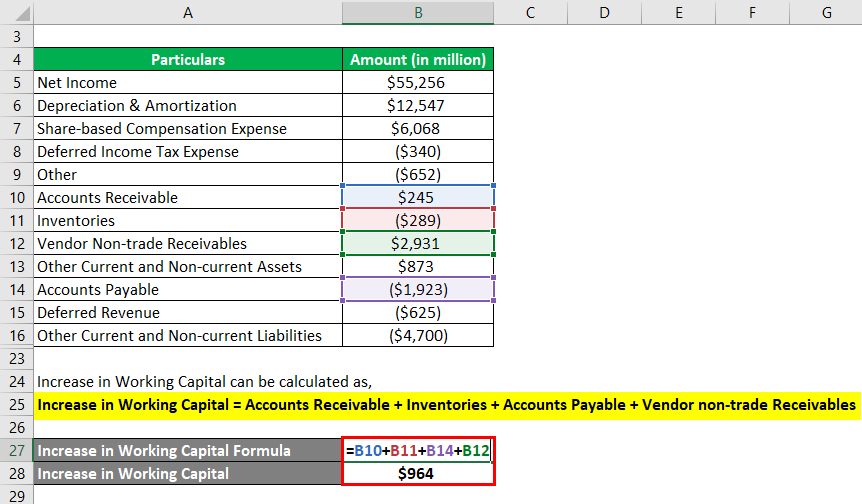

Operating Cash Flow Formula Examples With Excel Template Calculator

The second is used in the context of business accounting and is the act of.

. Paying an extra 100 a month on a 225000 fixed-rate loan with a 30-year term at an interest rate of 3875 and a down payment of 20 could save. Loan or mortgage amortization is a monthly payment that is a combination of both interest and the principal amount. The loan amortization schedule will show as the term of your loan progresses a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of.

Amortization extra payment example. Mortgage amortization is a financial term that refers to your home loan pay off process. The straight-line amortization calculation is the simplest way to repay a mortgage loanAlso referred to as a constant amortization the amount.

When you take out a mortgage the lender creates a payment schedule for you. The repayment structure of such a loan is such that every periodic. Almost any data field on this form may be calculated.

The first is the systematic repayment of a loan over time. It shows the regular payment. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine.

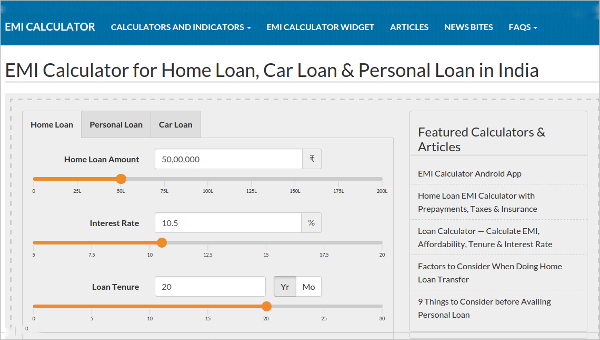

The calculator doesnt account for costs such as. It also determines out how much of your repayments will go. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments.

For example mortgages often have five-year terms but 25. The auto loan calculator lets you estimate monthly payments see how much total interest youll pay and the loan amortization schedule. An amortization schedule is a table that shows homeowners how much money they will pay in principal starting amount of the loan and in interest over time.

Your amortization schedule tracks this process of paying off the loan. Mortgage loan amortization is the process of paying a home loan down to 0. By inputting the terms of your loan including the amount interest rate and repayment schedule you can calculate the payment amounts for a fixed-rate loanWhether you have a mortgage a.

This amortized loan is then paid over a predefined period of time. An amortized loan is defined as a type of loan or debt financing that is paid back to the lender within a specified time. This may go beyond the term of the loan.

There are two general definitions of amortization.

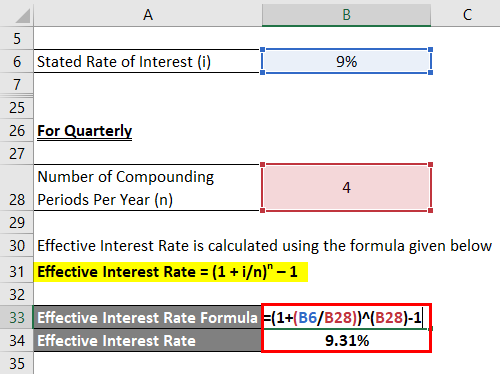

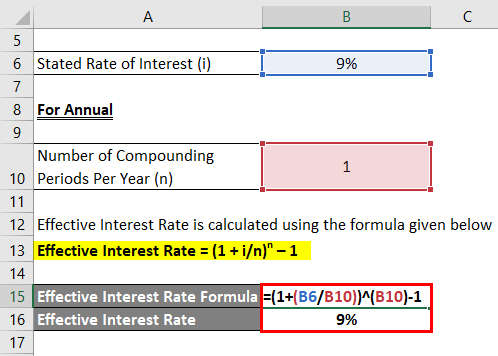

Effective Interest Rate Formula Calculator With Excel Template

26 Great Loan Agreement Template Contract Template Loan Best Loans

Amortization Of Intangible Assets Advantages And Disadvantages

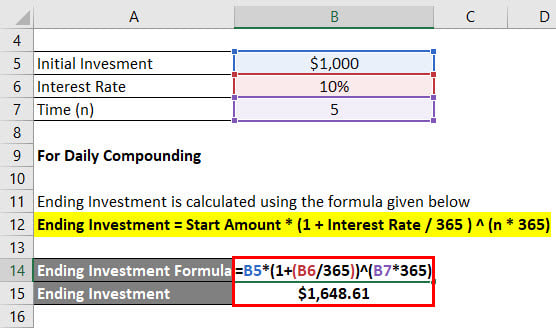

Daily Compound Interest Formula Calculator Excel Template

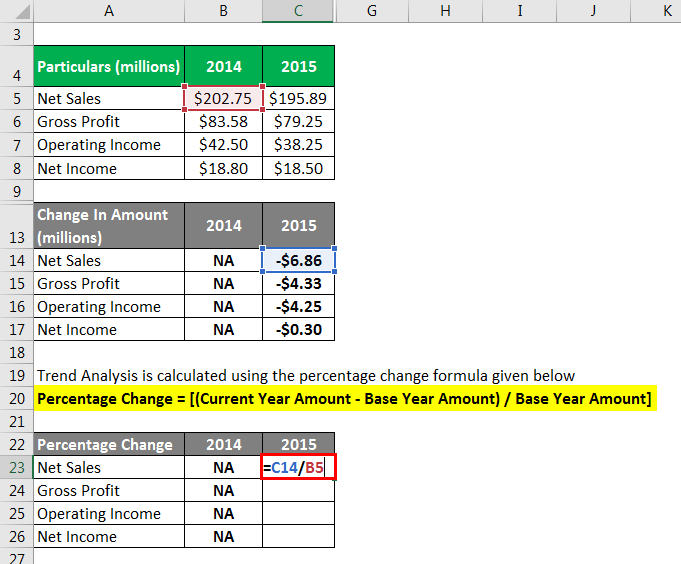

Trend Analysis Formula Calculator Example With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Interest Rate Formula Calculator With Excel Template

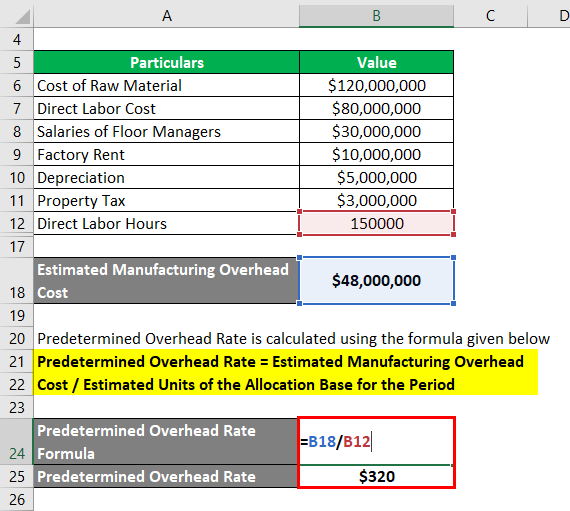

Predetermined Overhead Rate Formula Calculator With Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

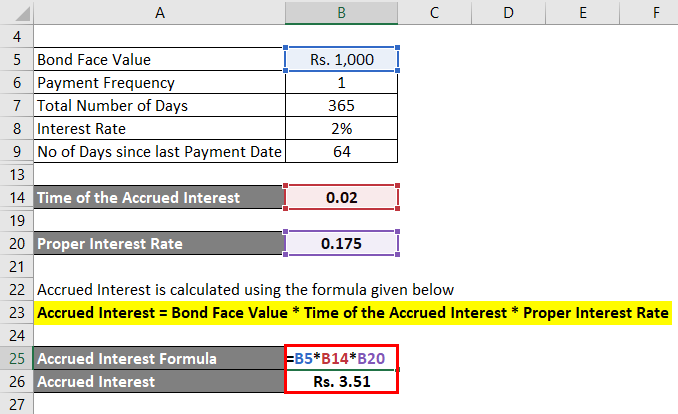

Accrued Interest Formula Calculator Examples With Excel Template

11 Best Amortization Schedule Maker Software Download Downloadcloud

11 Best Amortization Schedule Maker Software Download Downloadcloud

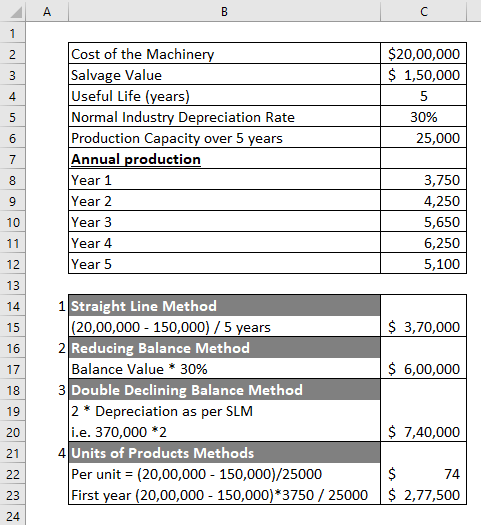

Depreciation A Complete Guide On Depreciation With Explanation

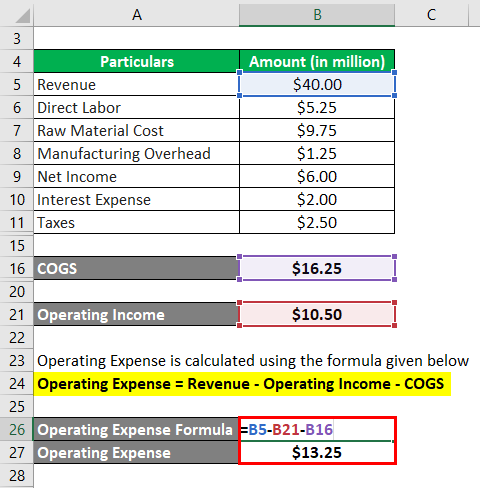

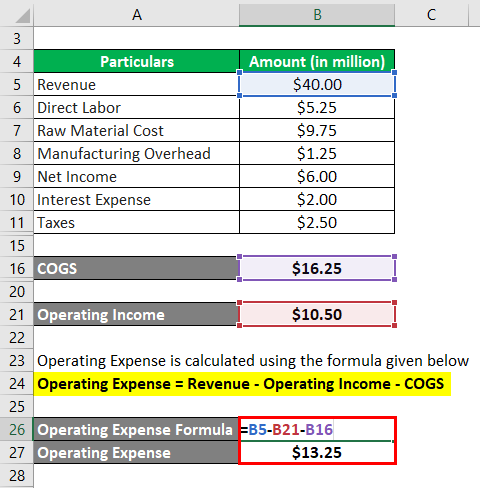

Operating Expense Formula Calculator Examples With Excel Template

Daily Compound Interest Formula Calculator Excel Template

Depreciation Vs Amortization Top 9 Amazing Differences To Learn

Maturity Value Formula Calculator Excel Template